Are Stablecoins the Business Model for Startup Societies?

Part 2/2 - Your airplane read for the Network State Conference in Singapore (here). Join us at Draper House in Singapore during Token49 (Oct 1 & 2) to dive deeper into these lessons (here).

By Niklas Anzinger

In my last piece, I outlined the main challenges startup society founders face. This time, I want to propose a business model that could solve some of those: stablecoins.

The idea comes from direct experience: issuing the $LIVES token, a USDC-pegged payment system in Próspera, now widely used by 40+ vendors on Roatán (see here).

This model is novel, and I expect objections. Still, it strikes me as a valuable experiment to overcome some of the challenges laid out in the previous piece, e.g. the fundability for real estate, land etc., and the cold start problem of high entry barriers.

The Case for Stablecoins

Stablecoin transaction volume already surpassed Visa and Mastercard in 2024, about $27-28 trillion processed. The USG has passed enabling legislation, and stablecoins are poised to power global financial markets on-chain, realising the promise of borderless low-cost transactions, transparency, and potential separation of state and money.

Few major issuers exist, but that’s already changing because it’s a powerful business model and the US enabling legislation. Tether alone reported $5.2 billion in profit in the first half of 2024, with fewer than 150 employees. If it achieved the same IPO valuation as Circle, Tether would rank among the world’s top five companies by market capitalization.

With US enabling legislation, the world is becoming multi-stablecoin (see episode here). Stablecoins resemble private banks: they hold deposits, issue a currency, and earn yield on reserves.

Historically, central banks displaced private banks. Startup societies can reclaim that role by offering opt-in alternatives. At $100m in reserves, a 5-10% yield means $5-10m in annual revenue. From there, you can build financial products, loans and conservative investments.

See where this is going?

Why Stablecoins Can Power Startup Societies

1.- Issuing a stablecoin is straightforward. Open a multisig with a reserve vault and launch the token (We started with $250k and issued 250k tokens on Solana). Próspera’s regulatory environment makes this easier, adding early credibility and oversight.

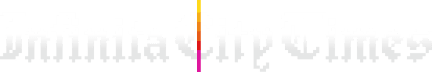

2.- You can show early traction Token launch platforms give visibility and analytics (see Solscan), letting you track transaction volume. If members use the token, you have real metrics for your startup society’s activity.

(Example of our $LIVES token dashboard.)

3.- Vendor adoption is easy. Restaurants, hotels and transport services want more customers. You bring them business, fuel the local economy, and provide easy redemption in local currency (Aleph/Crecimiento in Buenos Aires had this insight first, and we experienced the same thing in Roatan by doing it ourselves).

4. The vault can become the basis of your financial system. It will be a decision how conservative you want to be, but real estate or mortgage loans are not the highest-risk investments. From your stablecoin vault, you can fund the real estate buildout. As your portfolio grows, you can borrow more against real assets, cashflow etc.

The Challenges to Overcome

1.- User adoption. Vendors adopt easily; users are harder. The core question: why use your token instead of USDC, USD or the local currency?

Three answers:

Aspirational. The token signals identity: “this is my community.” In our case, $LIVES is the currency for people who don’t want to die (of course, not every participant in the economy needs to buy into that moral premise).

Crypto alternative to fiat: Vendors in your zone may not know USDC or Tether yet. You educate them, enabling crypto-native payments. Crypto-native is better for your users, but someone has to invest in vendor crypto education.

Incentives. To offset friction, you need upside:

Control UX with your own tooling (e.g. Infinita Wallet).

Finance discounts via vendor commissions (bulk demand).

Reward early users with equity-like tokens in the society

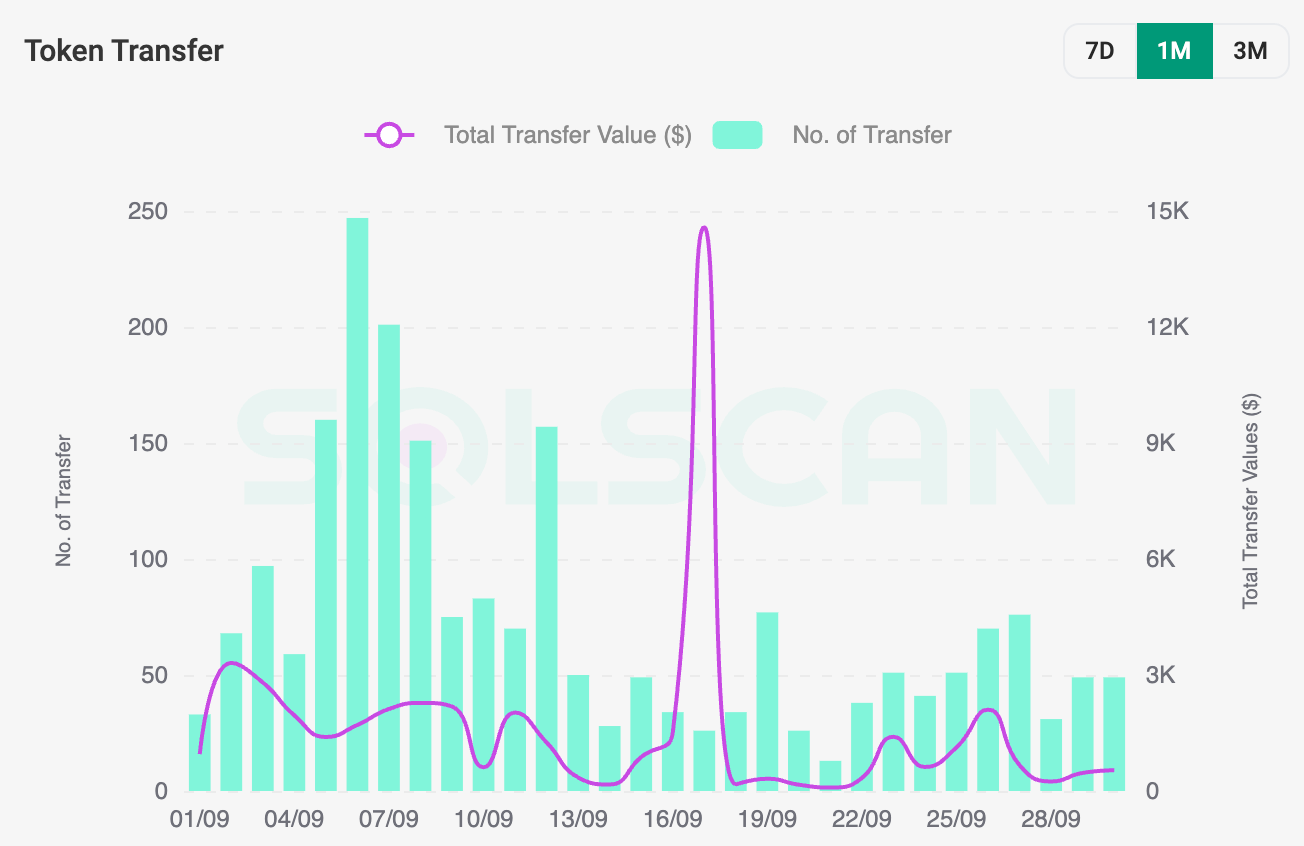

We haven’t launched the equity token yet, but Próspera’s regulatory framework makes it feasible. Rewarding the early community is a common path in crypto (see e.g. Venice).

(Venice is an example of how stablecoin + equity-like tokens can combine.)

2.- Early traction. Scaling beyond a pilot takes serious capital, $10-100m. One path is a new instrument: investors stake tokens in exchange for equity equal to the yield they forgo. Example: commit $10m for five years, receive ~5% per year in equity ($2.5m). This mirrors traditional startup equity economics, but with downside protection from real estate and land. It’s also a good vehicle for Balaji’s idea of a community “that crowdfunds territory around the world”. Stablecoins and programmable money makes that easier than fiat platforms.

This exact model hasn’t been tried yet, but I don’t see obvious barriers.

It seems some version of forgoing yield as investment is a big part of what’s underlying the recent much talked about Flying Tulip $200m seed round (see here).

3.- Commercial upside beyond the token. You won’t build a multi-billion dollar stablecoin by competing with USDC or Tether on security or market penetration. Their market is global trading; yours is the physical economy of your members and their partners. That means the upside must come from the value your community creates for the world.

In our case: a network of special regulatory zones for patient treatments and trial data, for example. Longevity clinics accept the token; patients may still want to pay in USD, but the backend converts to stablecoin. This way it still shows up in your network state dashboard.

This model is not easy, but potentially an improvement

Does this mean you need more than one business model or layer on risk in other ways than your core product? Normally you’d avoid that in a venture-funded startup. You shouldn’t really innovate on fundraising or governance, or layer on non-core product risk.

However, in the world of startup societies you’re not competing with easy horizontal SaaS businesses. You’re competing with a traditional real estate funding model.

For example, Próspera has to take on real estate funding and asset management, and it’s challenging to square with venture funding and culture (see my earlier piece). Prospera has to sell a lot of equity, and the cash is locked up in short-term unproductive land and not investing in technology or business development. You’re sacrificing a lot of cash/equity for the long-term.

Compared to this model, the stablecoin model could be nimbler, and more aligned with building a unified, tech-forward startup culture & a possibly better fundraising mechanism.

Your fundraising and growth path can look like the following:

Start with a small $1-5m pre-seed/seed round: issue the token, put $250-500k in the vault, show traction in the form of 200+ daily transactions from in-person living together.

Raise $10m (for $2.5m equity) for the land & real estate fund: from this you can probably allocate $3-5m for the first set of buildings & land purchases, give loans to residents etc.

Series-A: raise $20-50m in equity and $50m+ in token stakings, this is now a serious amount of money to build residential and commercial real estate for 100-500+ people.

And series-B+ you can imagine from there.

Proof Points Needed

The main three proof points required are:

Will early investors accept the stake-for-equity model?

Will regulators allow vaults backed with non-cash assets?

Is user adoption sustainable vs. other stablecoin alternatives?

Conclusion

The stablecoin model doesn’t remove all difficulties, real estate asset management may not be avoidable and you still have to succeed at building a unique advantage of your economy tied to its location and the value creation of its residents. But the model is promising by offering easy early traction metrics, internet-native distribution mechanisms (e.g. token listings) and the upside of programmable money as the underpinning of the society’s financial system.

I will report back as we learn from $LIVES adoption.

Yes